Our mission is to provide protection, professional representation, and peace of mind to our clients who are being aggressively pursued by Federal and State tax agencies.

Our team of experienced tax attorneys represent clients throughout the United States and internationally with complex tax problems and disputes. Our customized solutions enable you to overcome your tax problems and successfully get on with your life.

At our firm, only an experienced tax attorney will work on your case. We have represented and helped thousands of individuals and businesses in the United States resolve complex IRS and State Tax issues. Our strong relationships with the IRS and state taxing authorities allow us to work quickly to protect our client’s interests.

Options for resolving your tax problems will be assessed and explained to you.

Become a client, call with your tax attorney, begin in-depth investigation.

Negotiate best possible resolution with the IRS or State tax agencies.

Case completed. Your attorney will advise you how to stay tax compliant in the future.

Tax problems do not get better with time; but they can go away with our professional help and experience. There are many tax relief options for those who can’t pay their taxes. We understand the stress and anxiety that tax issues can cause. Our team of tax attorneys can help you make strides towards solving your tax problems.

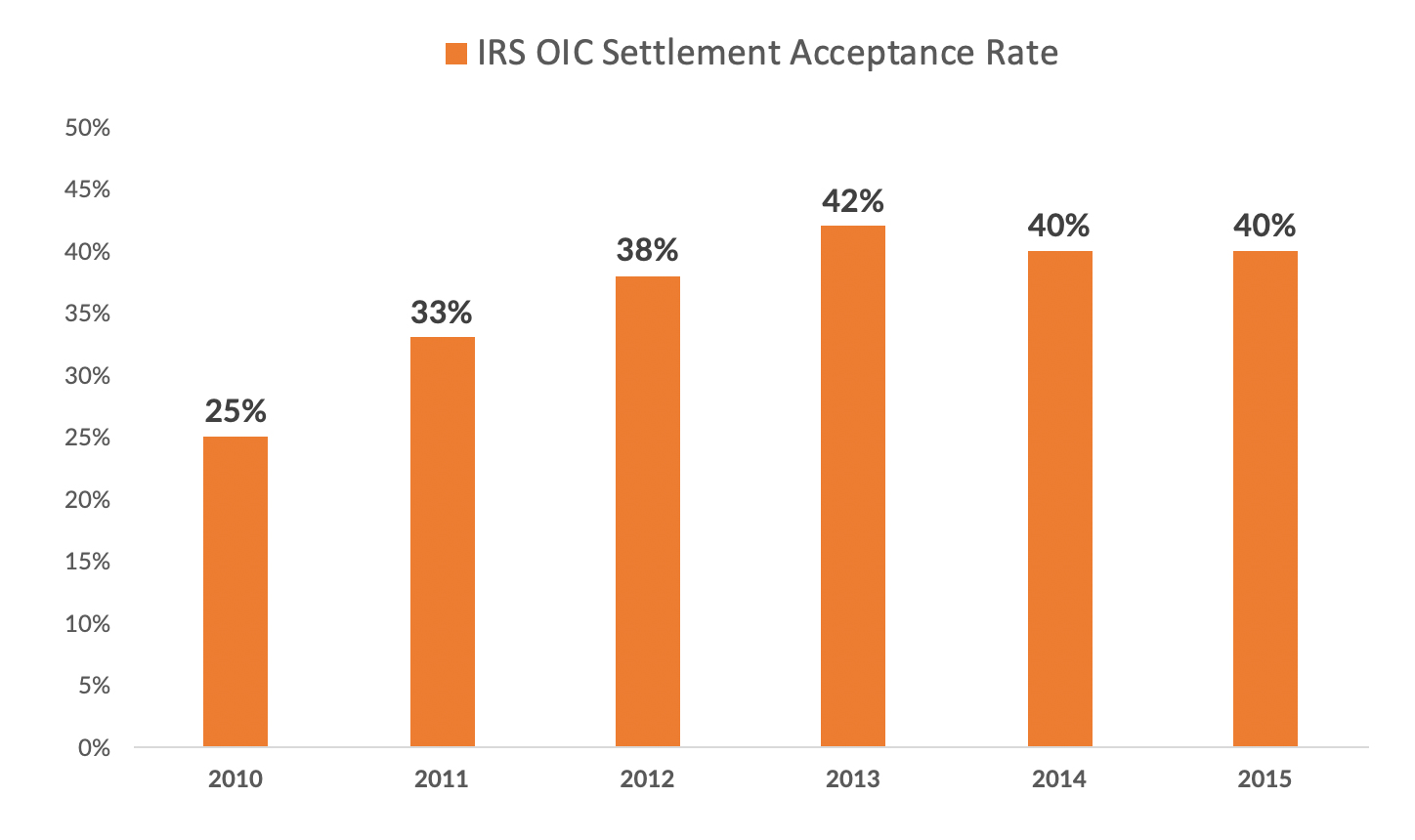

Because tax relief programs are based on extensive tax laws and court revenue ruling, it is important to have the most experienced and knowledgeable tax attorneys, CPAs, and ex-IRS agents to help you navigate the complexities. Our average customer owes the IRS over $10,000 in back taxes, and we have been able to save thousands of them by helping them pay significantly less than owed. We know how to make the law work in your favor.

Our flexible fee payments make professional representation affordable for everyone. Our first step will be to see if we can leverage the law to significantly lower your tax obligation. We will negotiate directly on your behalf to remove liens, stop garnishments and levies, reduce penalties and interest, structure partial-payment installments, and setup non-collectible status.

Source: IRS Data Book 2015

Call for Immediate Assistance (888) 559-8074

| Name | State/Federal | Offer Amount Accepted | Total Debt |

|---|---|---|---|

| Farra M. | New York | $2,500 | $25,908 |

| Kevin C. | Virginia | $22,000, with $367/mo payments over 60 months | $75,792.33 |

| Todd R. | New York | $7,791 (all penalties and interest abated), with $156.12/mo payments over 60 months | $13,943.97 |

| Debra K. | Federal | $1,500 | $60,000 |

| Ian M. | Federal | $100 | $57,000 |

| Nicholas G. | Federal | $1,000 | $88,000 |

| Eryka A. | Federal | $100 | $83,000 |

| Deseree W. | Federal | $80 | $32,000 |

| Dennis J. | Federal | $1,074 | $38,000 |

| Anthony C. | Federal | $2,500 | $43,000 |

| Tommy B. | Federal | $25 | $40,000 |

| Valerie B. | Federal | $21,000 | $302,401 |

| Kenneth J. | Federal | Appeals approved $60,300, pending final review from IRS counsel | $1,622,404.51 |

| Chris A. | Federal | $157 | $10,000 |

| Heather N. | Federal | $168 | $30,000 |

| Chuck B. | Arkansas | $84,000 | $147,000 sales tax debt |

Tax problems do not get better with time; they only get worse. Reacting quickly to notices from the IRS or State tax agencies is vital to prevent further collection actions. By waiting, you will incur huge penalties and interest, and risk losing your home, business, or income, due to unresolved tax issues.

We understand that having tax issues can affect multiple aspects of your life such as your health, your family, and your overall peace of mind. In all collection matters and audit cases, we can provide several options for resolving your tax issues.

Don’t be overwhlemed by complex tax issues.

Our tax lawyers work with the IRS daily and have many inroads to help people like you out of bad situations. We represents individuals and businesses in all 50 states that have complex IRS and State tax issues.

Small Business Owners

Truckers

Contract Workers (1099)

Professionals

Real Estate Agents

Day Care Centers

J. David Tax Law® is an award-winning tax firm that represents individuals and businesses in all 50 states that have complex IRS and State tax issues. Using this form does not constitute an attorney client relationship.